How much will a rate cut help?

Everybody is expecting a rate cut by the Reserve Bank of India (RBI), a belief now buoyed by US Federal Reserve chairperson Janet Yellen becoming a super dove in her recent utterances. But will a 25 to 50 basis points cut by the RBI revive corporate health?

One way to answer that question is to look at what happened to the most vulnerable sectors of the economy as a result of the RBI reducing its repo rate from 8% in January 2014 to 6.75% in September last year.

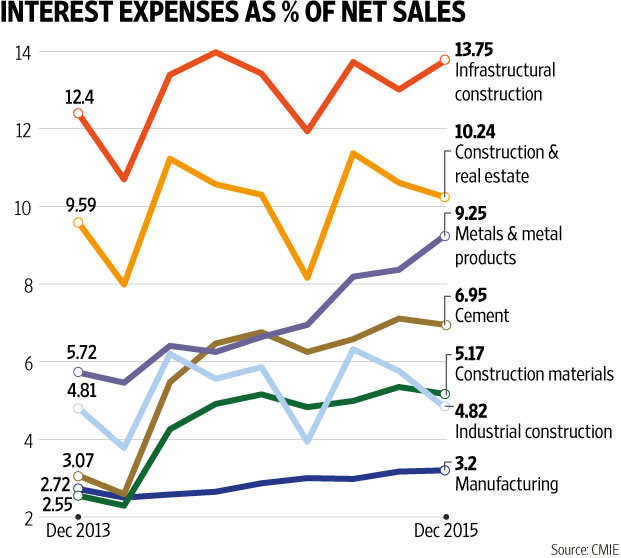

The chart has the details. The interest expense ratio, which is the ratio of interest paid by a company to its net sales, has been flat or rising for most sectors, in spite of lower interest rates. Core sectors like real estate and construction, industrial and infrastructure construction, metals and metal products, cement, mining, electricity generation and electricity distribution are worse off than before.

There could be two reasons for this rather surprising result. Either the rate cuts have not led to lower interest outflow because companies continue to draw higher working capital. Or the rate cuts haven’t really stoked demand and have thus not yet translated into revenue growth for firms. The latter seems more likely, given that India is not delinked from the global slowdown, in addition to having its own domestic issues like monsoon deficit and rural distress.

CMIE data shows that sales growth for the manufacturing sector as a whole has been negative for the past five quarters. For metals and metal products, sales growth has been negative for the past four quarters. For other core sectors, sales growth has been either marginally negative or slightly positive.

The solution to lower interest expense, therefore, lies in a significant increase in revenue. But that will happen in real estate only if property prices come down and affordability improves. Other core areas like cement and construction will then follow.

Until now, benefits of the interest rate cut have trickled down to lower interest expense only in a few sectors like auto and auto components, food products and fast moving consumer goods where the working capital needs are relatively low and revenue growth has been slightly better. A rate cut will also help the consumer durables sector. Banks will benefit to the extent that bond prices rise and they make mark-to-market gains on their portfolios.

The hope is that a rate cut will boost consumer demand in sectors such as autos and consumer durables. But there is unlikely to be any immediate benefit to the core sectors.